The history of Bear Markets makes for gloomy reading1. However, this brief note focuses on what we might expect once the -20% threshold has been crossed. How has the market (S&P 500) performed after entering a Bear Market?

Key Takeaways

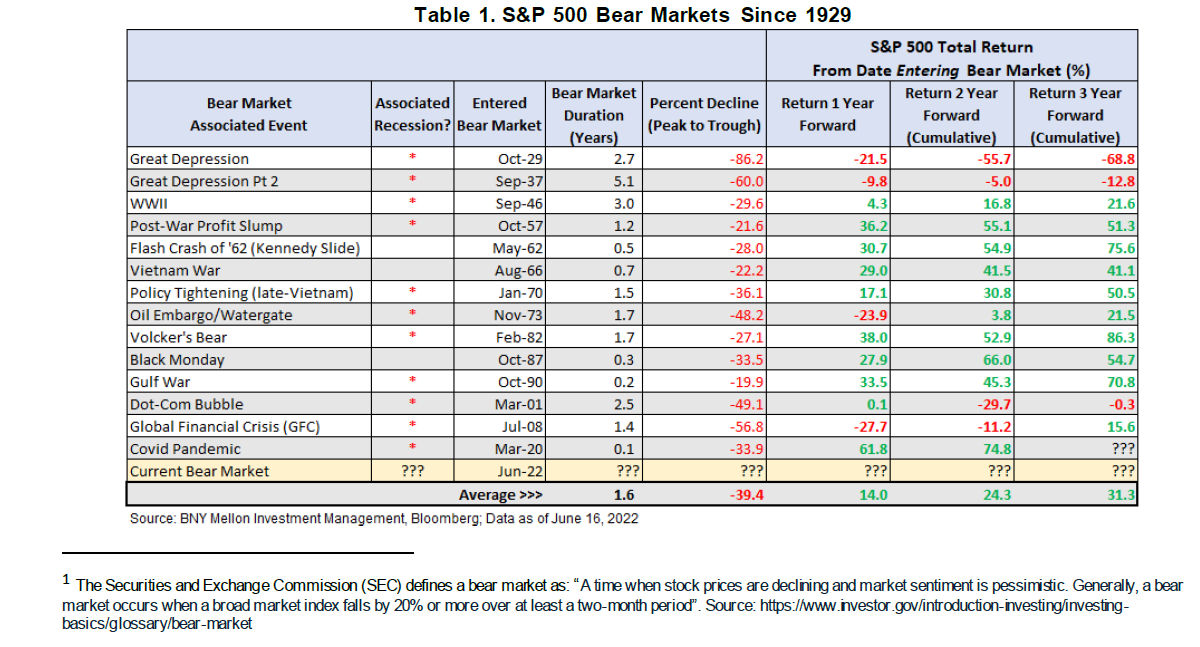

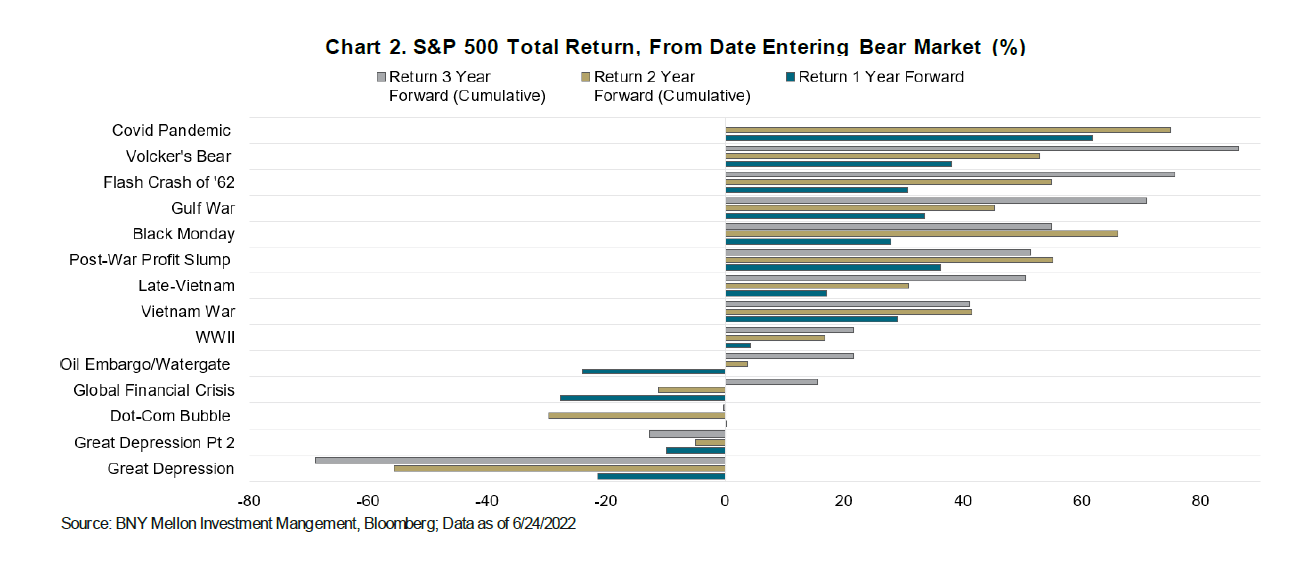

• After entering a bear market, defined as the first day that the S&P 500 closes more than 20% below the recent high, from that date the 1-year forward total return averages 14% and in only four bear markets was the subsequent 1-year return negative (see Table 1 below).

• Put another way, after entering a bear market, the S&P 500 had a positive return in the following 1-year period more than 70% of the time (10 out of 14). This is a small sample, and the 20% definition is arbitrary. Yet, this statistic points to the resiliency of markets, and the US economy, over a ~100-year period.

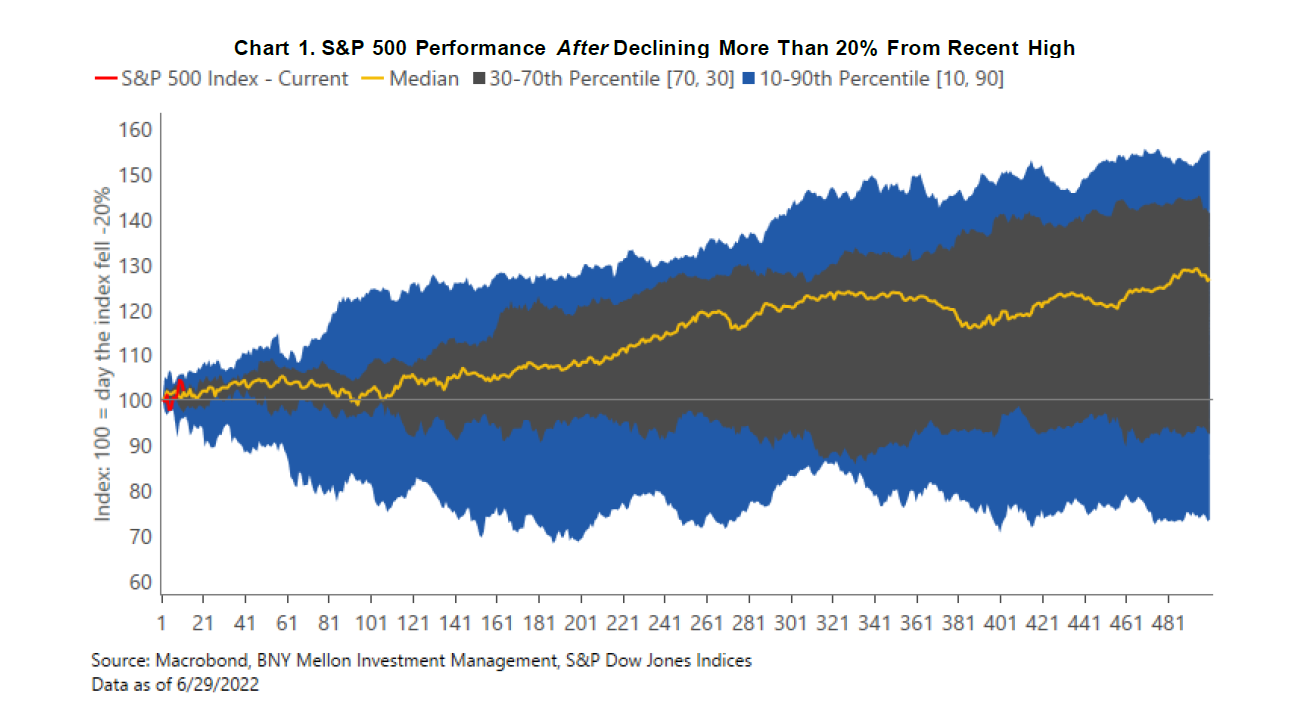

• Cumulative returns in the subsequent two and three years are also positive with notable exceptions being the Great Depression and 2000’s Dot-Com Bubble. There is wide dispersion to consider. In some instance it takes years for bear market losses to be recouped. However, the median path of the S&P is clearly upward, particularly about a hundred days after entering a bear market (see Chart 1 below).

• Bear markets average 1.6 years (peak to trough) and see declines of ~39% across 14 bear markets since 1929 (not including the current bear market which may not have bottomed yet). Expectedly, most bear markets are associated with economic recessions. However, the few that were not tended to be shorter in duration and with peak to trough declines moderately less severe than the full-sample average.

• The bear market most salient for today is the so-called “Volcker Bear” that began in late-1980 and lasted until 1982. Fed Chair Paul Volcker attacked double digit inflation with a series of rate hikes and induced recessions. In this instance, after trading into a bear market in February 1982, the market rebounded strongly beginning in the second half of the year as policy rates began to be cut to more normal levels (i.e., below 10%). US inflation peaked in early-1980 but remained above 10% until late-1981. The takeaway: inflation must be tamed, and the monetary policy stance pivoted, before the next enduring market rally can begin to take shape.

FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS. FOR GENERAL PUBLIC DISTRIBUTION IN THE U.S. ONLY.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY Mellon or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY Mellon and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. To the extent that these materials contain statements about future performance, such statements are forward looking and are subject to a number of risks and uncertainties. Information and opinions presented have been obtained or derived from sources which BNY Mellon believed to be reliable, but BNY Mellon makes no representation to its accuracy and completeness. BNY Mellon accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: For Institutional, Professional, Qualified Investors and Qualified Clients. For General Public Distribution in the U.S. Only. • United States: by BNY Mellon Securities Corporation (BNYMSC), 240 Greenwich Street, New York, NY 10286. BNYMSC, a registered broker-dealer and FINRA member, and subsidiary of BNY Mellon, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Mellon Investment Management firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Fraumünsterstrasse 16, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • Singapore: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Australia: BNY Mellon Investment Management Australia Ltd (ABN 56 102 482 815, AFS License No. 227865). Authorized and regulated by the Australian Securities & Investments Commission. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario.

BNY MELLON COMPANY INFORMATION

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally. • Insight Investment – Insight North America LLC (INA) is a registered investment adviser under the Investment Advisers Act of 1940 and regulated by the US Securities and Exchange Commission. INA is part of ‘Insight’ or ‘Insight Investment’, the corporate brand for certain asset management companies operated by Insight Investment Management Limited including, among others, Insight Investment Management (Global) Limited (IIMG) and Insight Investment International Limited (IIIL) and Insight Investment Management (Europe) Limited (IIMEL). Insight is a subsidiary of The Bank of New York Mellon Corporation. • Newton Investment Management – Newton” and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIM is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business. Both Newton firms are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. • Alcentra – The Bank of New York Mellon Corporation holds the majority of The Alcentra Group, which is comprised of the following affiliated companies: Alcentra Ltd. and Alcentra NY, LLC. which are registered with the U.S. Securities & Exchange Commission under the Investment Advisers Act of 1940. Alcentra Ltd is authorized and regulated by the Financial Conduct Authority and regulated by the Securities Exchange Commission. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of BNY Mellon. • Dreyfus Cash Investment Strategies (Dreyfus) is a division of BNY Mellon Investment Adviser, Inc. (BNYMIA) and Mellon Investments Corporation (MIC), each a registered investment adviser and subsidiary of BNY Mellon. Mellon Investments Corporation is composed of two divisions; Mellon, which specializes in index management and Dreyfus which specializes in cash management and ultra short strategies. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of BNY Mellon. • Siguler Guff – BNY Mellon owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC).

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

©2022 THE BANK OF NEW YORK MELLON CORPORATION

IS-280741-2022-06-24

GU-271 – 24 July 2023

Tracking # 1-05299753